A country’s economic stability depend on things like the goods and services it could produce, armed conflicts, health crises, marketplace traits and consumer self belief.

Several Economic recessions have happened throughout records, harming the finances of human beings and companies throughout society. Governments at all stages around the sector generally take motion to avoid financial downturn; but, they’re now not usually a hit. But if recessions have befell regularly before, why is there the regular risk that they’ll appear once more? What causes them? What is their impact?

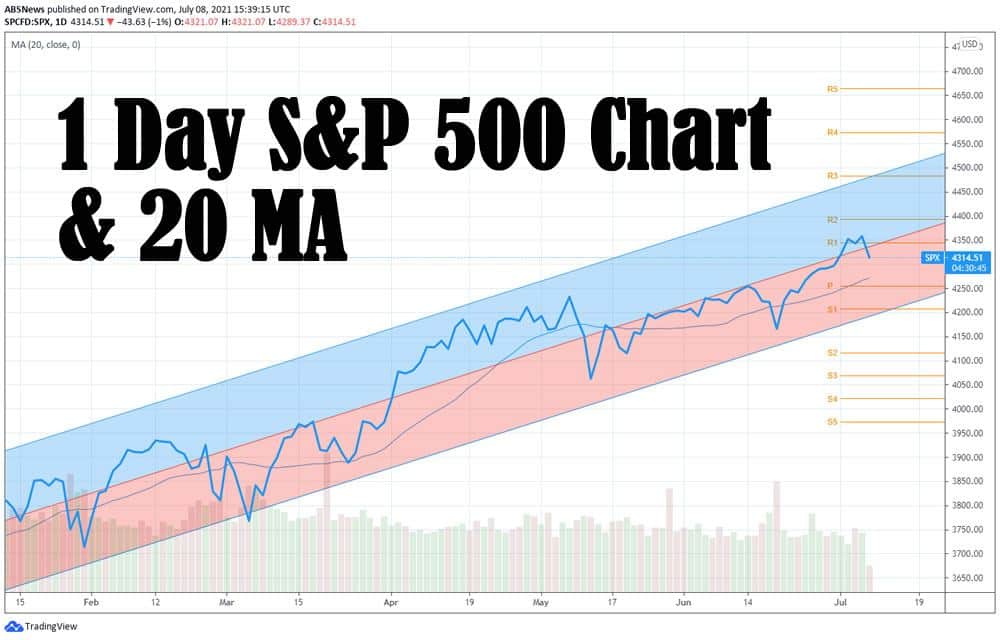

The economic system is going via cycles of highs and lows, just like a wave within the ocean: while it grows, its crest comes to a peak, declines after which starts of evolved to upward thrust once more. when the economic system goes up, it is referred to as “economic growth”; however when it is going down, it’s called “recession contraction” (or “downturn”).

If the financial system shrinks for 2 consecutive quarters, it is said to have gone into recession. In trendy, that is determined through an indicator referred to as the “Gross Domestic Product” (or “GDP”). Peoples commonly confuse “recession” and “slowdown”; but, growth signs in a recession are terrible (i.e. the wave is falling) but tremendous in a slowdown (i.e. the wave is rising) albeit at a slower charge than within the previous zone.

What causes monetary recession?

All recessions have different reasons and results. Economies experiencing boom are likelier to fall into recession as a part of the monetary cycles. however, other elements can reason recession, many of which cannot be predicted or averted. Right here are three common reasons of recession.

Oversupply. In an financial boom, groups generally tend to boom manufacturing to satisfy patron call for. when demand peaks and starts of evolved to say no, the immoderate deliver of products and offerings that aren’t fed on can lead to a recession, with organizations producing much less and downsizing whilst people lose buying power and intake keeps to fall.

Uncertainty. Not knowing how the economic system will exchange makes commercial enterprise decision-making riskier. Wars and pandemics are situations which can make customer traits unpredictable within the brief, medium and long time, accordingly generating financial uncertainty. because corporations and those hold off on spending and funding choices, financial interest declines.

Speculation. In general, economic bubbles shape whilst the price of something all at once rises because of hypothesis, market developments or customer self belief. traders buy it up, hoping to earn a return from the price boom. but, once they begin to sell it off, deliver exceeds call for (i.e. there are fewer new customers) and drives fees down, inflicting the bubble to burst. This took place with tulips in the seventeenth century and the housing market in 2008.

The longer the monetary recession, the tougher it’s far to opposite its results, like low consumption, low funding, fewer goods and offerings, and unemployment. It also heightens the risk of an monetary depression, the next rough patch the economic system can undergo.

Lifeyet News Lifeyet News

Lifeyet News Lifeyet News